Economic Trends 2025: Challenges & Opportunities for Growth

Top International Loan Providers Guide for 2025

April 9, 2025

Unleash Growth: No-Fail Business Finance & Loans Guide 2025

April 15, 2025Economic Trends 2025: Challenges & Opportunities for Growth

Top Economic Trends Shaping 2025

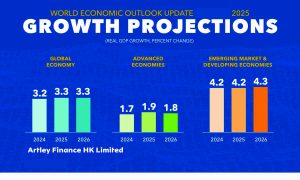

Global Economic Trends-Growth Projections for 2025

Global GDP growth projections for 2024-2026.

The International Monetary Fund projects global growth at 3.2% for 2025, aligning with 2024 estimates. Advanced economies expect a modest uptick, with growth rising from 1.6% in 2023 to 1.8% in 2025. Emerging markets, however, anticipate a slight slowdown, dropping from 4.3% in 2023 to 4.2% in 2025. These projections reflect cautious optimism, balancing recovery efforts with persistent risks like trade tensions and inflation.

Regional disparities persist. East Asia and Pacific regions face decelerating growth due to large economies cooling, while Latin America and Sub-Saharan Africa project stronger domestic demand driving gains. Businesses must monitor these variations to optimize market entry and investment strategies. For instance, companies targeting South Asia can leverage robust consumption trends, whereas those in Europe must navigate slower growth.

Trade Policies Reshaping Global Markets

Trade policies significantly influence the world economy today. Recent tariffs, particularly from major economies like the United States, disrupt supply chains and inflate costs. The Organisation for Economic Co-operation and Development notes that such measures could shave 0.5% off global GDP by 2027 if unresolved. Companies reliant on cross-border trade face higher operational costs, prompting supply chain diversification.

Businesses adapt by exploring alternative sourcing. For example, firms shift manufacturing from tariff-heavy regions to ASEAN countries, where costs remain competitive. This realignment demands agility, as delays in restructuring risk profit erosion. Stakeholders must prioritize trade policy updates to mitigate exposure, ensuring compliance with evolving regulations..

Inflation and Monetary Policy Adjustments

Inflation continues shaping economic strategies globally. The World Bank reports global headline inflation dropping to 4.4% in 2025 from 5.8% in 2024, yet core inflation declines more gradually. Central banks, including the Federal Reserve and European Central Bank, adjust monetary policies cautiously, balancing growth with price stability. Interest rates remain elevated in some regions, impacting borrowing costs for businesses and consumers.

Higher rates challenge small and medium enterprises, limiting expansion plans. Conversely, sectors like technology benefit from cooling inflation, as consumer spending stabilizes. Businesses must forecast cash flow under varying rate scenarios, leveraging fixed-rate financing to hedge against hikes. Monitoring central bank announcements ensures timely strategic pivots.

Check out our other article: Artley Finance – Ultimate Bank Instruments Provider Success.

Technological Advancements Driving Productivity

Technology transforms the global economy, boosting productivity across industries. Artificial intelligence and automation streamline operations, cutting costs for manufacturers and service providers. The World Economic Forum estimates AI could add $15.7 trillion to global GDP by 2030. Companies adopting these tools gain competitive edges, particularly in data-driven decision-making.

However, technology adoption requires significant capital. Small businesses, often constrained, risk falling behind larger competitors. Training workforces for digital tools bridges this gap, ensuring scalability. Firms must align tech investments with long-term goals, avoiding overhyped solutions lacking proven returns.

Supply Chain Resilience in Action

Consider a mid-sized U.S. electronics manufacturer facing tariff-induced cost spikes in 2025. Initially sourcing components from China, the company encountered a 25% tariff increase, threatening margins. Leadership swiftly diversified suppliers, partnering with facilities in Vietnam and Malaysia. By renegotiating contracts and optimizing logistics, the firm reduced costs by 15% within six months. This agility preserved profitability, demonstrating how proactive adaptation mitigates trade policy risks.

Such examples highlight the need for contingency planning. Businesses must map supply chains, identifying vulnerabilities to external shocks. Regular audits and supplier diversification ensure resilience, safeguarding operations against geopolitical uncertainties.

Renewable Energy Expansion in Germany

Germany’s renewable energy sector offers a compelling case study for navigating today’s economy. Facing energy price volatility post-2022, Germany accelerated its Energiewende (energy transition) program. By 2025, renewables account for 50% of electricity production, up from 41% in 2020. Government subsidies and private investments fueled this growth, with firms like Siemens Energy scaling wind turbine production.

The sector faced challenges, including supply chain bottlenecks for rare earth metals. Companies countered by investing in domestic recycling and alternative materials, reducing reliance on imports. This strategic shift created 300,000 jobs and boosted GDP by 1.2% annually, per government data. Businesses worldwide can emulate Germany’s model, aligning with green trends to capture market share.

Geopolitical Risks and Economic Stability

Geopolitical tensions, from trade wars to regional conflicts, test economic stability. Disruptions in key shipping routes, like the Red Sea, inflate logistics costs, impacting retailers and manufacturers. The World Trade Organization reports a 10% rise in global shipping costs since 2023, squeezing margins for import-dependent firms. Businesses must factor these risks into pricing and inventory strategies.

Hedging against currency fluctuations protects against geopolitical volatility. Multinational corporations often use forward contracts to lock in exchange rates, stabilizing budgets. Smaller firms can explore local sourcing to minimize exposure, ensuring operational continuity amid global unrest.

Emerging Markets as Growth Engines

Emerging markets drive global growth, with South Asia and Sub-Saharan Africa projected to outpace advanced economies. India’s GDP growth hovers at 6.8% for 2025, fueled by infrastructure spending and digitalization. Businesses targeting these regions benefit from expanding consumer bases, particularly in retail and fintech.

Challenges include regulatory complexity and infrastructure gaps. Firms entering India, for instance, navigate bureaucratic hurdles but gain from streamlined digital payment systems. Partnering with local entities accelerates market penetration, leveraging regional expertise to overcome barriers.

Sustainability Shaping Business Strategies

Sustainability influences corporate agendas as consumers and regulators demand accountability. The European Union’s Carbon Border Adjustment Mechanism, set for full implementation in 2026, taxes high-carbon imports, pushing firms to adopt green practices. Companies investing in renewable energy and circular economies reduce compliance costs while enhancing brand value.

Transitioning to sustainable models requires upfront investment but yields long-term savings. Retail giants like Unilever report 20% cost reductions from eco-friendly packaging since 2020. Businesses must integrate sustainability into core strategies, aligning with global trends to remain competitive.

Workforce Dynamics and Labor Markets

Labor markets evolve, with remote work and gig economies reshaping employment. The International Labour Organization notes a 5% rise in global remote workers since 2020, boosting flexibility but challenging team cohesion. Businesses adopting hybrid models balance productivity with employee satisfaction, reducing turnover.

Skill shortages persist, particularly in tech and healthcare. Upskilling programs address this, with firms like IBM training 30,000 employees in AI by 2025. Companies must prioritize talent development, aligning workforce capabilities with market demands to sustain growth.

FAQ: Navigating the World Economy Today

What factors drive global economic growth in 2025?

Global growth stems from regional demand, technological advancements, and monetary policy adjustments. Emerging markets like India and robust sectors like renewable energy contribute significantly.

How do tariffs impact businesses today?

Tariffs raise costs for importers, disrupt supply chains, and reduce competitiveness. Businesses counter by diversifying suppliers and optimizing logistics.

Why is inflation still a concern in 2025?

Despite declining headline inflation, core inflation remains sticky, prompting cautious central bank policies that elevate borrowing costs.

How can businesses adapt to geopolitical risks?

Businesses hedge currency risks, diversify supply chains, and localize operations to mitigate disruptions from trade wars or conflicts.

What role does sustainability play in today’s economy?

Sustainability drives compliance with regulations like the EU’s carbon tax and enhances brand value, cutting long-term costs.

Seizing Opportunities in a Dynamic Economy

The world economy today presents a tapestry of challenges and opportunities. From trade policy shifts to technological leaps, businesses must adapt swiftly to thrive. By leveraging data-driven insights, diversifying strategies, and embracing sustainability, companies position themselves for resilience and growth. Emerging markets offer untapped potential, while workforce upskilling ensures competitiveness. Artley Finance commits to guiding clients through this landscape, delivering tailored strategies for success. #GlobalEconomy #EconomicTrends #BusinessStrategy

Ready to navigate the global economy with confidence? Contact Artley Finance today for personalized insights and strategies that drive results. Don’t wait secure your financial future now!

Check out another powerful read: top-international-loan-providers-2025

Email us: finance@artleyfinance.com

Visit our website: www.artleyfinance.com