Letters of Credit (LC) in International Trade: A Complete Guide

Banned Loan & Bank Instrument Providers List

January 31, 2025

Your Trusted SBLC & Bank Guarantee Provider | Artley Finance HK

February 3, 2025Letters of Credit (LC) in International Trade: A Complete Guide

- Bank Guarantee

- commercial letter of credit

- confirmed letter of credit

- documentary letter of credit

- how a letter of credit works

- import export LC

- International Trade

- LC

- LC in international trade

- Letter of Credit

- letter of credit definition

- letter of credit process

- letter of credit types

- revolving letter of credit

- secure international transactions

- Standby Letter of Credit

- Trade Finance

- trade finance solutions

- trade payment guarantee

- transferable letter of credit

- types of letter of credit

Introduction

Engaging in international trade can be exciting, but it also comes with financial risks—payment defaults, currency fluctuations, and unfamiliar business partners. So how can companies protect themselves?

A Letter of Credit (LC) provides a secure payment mechanism, ensuring that sellers receive payment and buyers get their goods as agreed. This trade finance tool fosters trust in cross-border transactions, making global expansion smoother and safer.

In this guide, we’ll break down how LCs work, their various types, key advantages, and the step-by-step process that businesses follow to execute international transactions successfully.

Types of Letters of Credit (LC)

Letters of Credit (LCs) are financial instruments issued by banks to guarantee that a seller will receive payment as long as they meet the agreed conditions. Various types of LCs exist, each suited to different business needs and risk levels.

1. Commercial Letter of Credit (Import/Export LC)

A Commercial LC, also known as a Documentary LC, is the most widely used LC in trade finance. It acts as a primary payment mechanism rather than a backup, ensuring that the seller gets paid once they submit the required documents, such as the bill of lading, invoice, and insurance certificate.

This type of LC is commonly used in international trade to mitigate payment risks between importers and exporters, especially when the trading parties are unfamiliar with each other.

2. Standby Letter of Credit (SBLC)

Unlike a Commercial LC, an SBLC serves as a safety net rather than a direct payment tool. It only comes into effect if the buyer fails to fulfill their contractual obligations, whether related to payment, performance, or delivery.

Since SBLCs function as a guarantee of last resort, they are often used in long-term contracts, construction projects, and international tenders where the risk of default exists.

3. Revolving Letter of Credit

A Revolving LC is issued for businesses engaged in repeated transactions over a set period. Instead of issuing a new LC for every order, a single Revolving LC covers multiple shipments within a defined timeframe.

This LC can be structured in two ways: Time-based: The credit is restored after a certain period (e.g., monthly or quarterly) Value-based: The credit is replenished after each shipment or payment is completed.

4. Confirmed Letter of Credit

Involves an additional guarantee from a second bank, usually located in the seller’s country. This extra layer of security is useful when dealing with buyers from countries with unstable economies, weak banking systems, or high political risk. Since the confirming bank assumes financial responsibility along with the issuing bank, sellers have greater assurance that they will receive payment. However, this also increases transaction costs due to added confirmation fees.

For Example : A textile manufacturer in India is shipping garments to a buyer in Venezuela. Due to economic instability in Venezuela, the Indian exporter requests a Confirmed LC from an international bank that guarantees payment in addition to the Venezuelan buyer’s bank.

5. Unconfirmed Letter of Credit

An Unconfirmed LC means that only the issuing bank (the buyer’s bank) provides the payment guarantee. No second bank is involved in confirming the transaction. This is generally used when the seller trusts the issuing bank and does not require an additional guarantee. However, the seller takes on slightly more risk, as they rely solely on the financial strength of the issuing bank.

6. Transferable Letter of Credit

This allows the beneficiary (seller) to transfer part or all of the credit to a second beneficiary, such as a supplier, manufacturer, or subcontractor. This is particularly useful in complex trade transactions where intermediaries or brokers are involved. This ensures that suppliers get paid while allowing the primary beneficiary to act as a middleman without using their own capital to fund the transaction.

7. Red Clause Letter of Credit

Enables the seller to receive an advance payment before shipping the goods. The issuing bank provides a pre-agreed portion of the total payment upfront to help the seller cover production, sourcing, and logistics costs. This is typically used when sellers require working capital to manufacture or procure goods before shipment. The name “Red Clause” originates from the early practice of printing this special condition in red ink on LC documents.

8. Green Clause Letter of Credit

similar to a Red Clause but provides additional financing for storage, insurance, and other pre-shipment expenses. It is commonly used in industries where goods must be stored in bonded warehouses before delivery.

It is ideal for transactions involving commodities, perishable goods, and bulk shipments that require temporary warehousing since this LC covers both working capital and logistics costs,

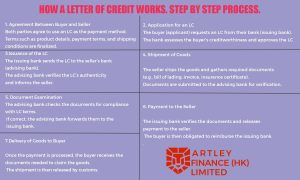

Understanding the step-by-step process of a Letter of Credit (LC) in trade finance. A secure payment method for international transactions

How a Letter of Credit Works

A Letter of Credit is a financial guarantee issued by a bank to facilitate trade between buyers and sellers. The process typically involves the following steps:

- Agreement Between Buyer & Seller – Both parties agree to use this payment method and finalize trade terms.

- Application for LC – The buyer submits a request to their bank, which reviews their financial standing before issuing approval.

- Issuance & Verification – Once approved, the bank sends the financial guarantee to the seller’s bank for validation.

- Shipment of Goods – The seller dispatches the goods and submits the necessary shipping and commercial documents.

- Document Review – The advising bank ensures all documents comply with the agreed terms before forwarding them to the issuing bank.

- Payment to Seller – Upon successful verification, the bank releases payment to the seller.

- Delivery to Buyer – The buyer receives the required documents to claim the goods, which are then cleared through customs.

What is the purpose of Letter of Credit?

A Letter of Credit gives both buyers and sellers peace of mind in a business transaction. Issued by a bank, it acts as a safety net, guaranteeing that the seller gets paid as long as they meet the agreed terms. This helps build trust, especially in international trade, where dealing with unfamiliar partners can feel risky.

To safeguard your financial interests, always engage with reputable and licensed financial institutions like Artley Finance (HK) Limited which has been delivering bank guarantees and SBLC to customers since 1982. Artley Finance (HK) Limited is a trusted leader in the industry, ensuring secure and authentic financial instruments. If you’re looking to raise capital or need more information about our financing solutions, we’re here to assist you. At Artley Finance HK Limited, we specialize in the efficient issuance, leasing, funding, and monetization of bank instruments like SBLCs and BGs. Contact us today to learn how we can help you access the financial tools you need to achieve your goals.

Secure Your International Transactions Today!

Email: finance@artleyfinance.com

Website: www.artleyfinance.com

Ensure safe, seamless global transactions with the right financial instruments!

2 Comments

[…] Finance: Usance Letters of Credit, Deferred Letters of […]

[…] to risk non-payment, and your buyer doesn’t want to pay upfront without assurance of delivery. A letter of credit (LC) solves this problem. It’s a bank’s commitment to pay the seller once the conditions in the […]