BG vs SBLC: Understanding the Key Differences Between Bank Guarantees and Standby Letters of Credit

Bank Draft vs. Wire Transfer: Which is Safer for Large Transactions?

February 16, 2025

Top Bank Guarantee Providers in 2025 & How They Support Global Trade

February 20, 2025BG vs SBLC: Understanding the Key Differences Between Bank Guarantees and Standby Letters of Credit

BG vs SBLC Key Differences

In the world of trade finance, businesses often rely on bank guarantees (BGs) and standby letters of credit (SBLCs) to secure transactions, mitigate risks, and build trust between parties. However, many people struggle to understand the fundamental differences between these two financial instruments. While both BGs and SBLCs serve as financial assurances, they differ in purpose, structure, and usage.

As a leading bank guarantee provider and SBLC provider, Artley Finance (HK) Limited specializes in issuing and monetizing financial instruments to facilitate global trade and business growth. Let’s explore the key distinctions between bank guarantees (BGs) and SBLCs, helping you determine which option best suits your financial needs.

What is a Bank Guarantee (BG)?

A bank guarantee is a promise from a financial institution to cover a debtor’s obligations if they default. This makes it easier for parties to enter contracts with confidence. This assurance is especially critical in high-risk or unfamiliar business environments. It provides security in commercial transactions, construction projects, real estate deals, and performance-based contracts.

Types of Bank Guarantees

There are several types of bank guarantees, each with a specific use:

- Performance Guarantee: Ensures that a service or product delivery meets contract terms.

- Advance Payment Guarantee: Secures the repayment of advance payments if the seller doesn’t deliver.

- Financial Bank Guarantee: Covers loan repayment or other financial obligations.

- Shipping Guarantee: Facilitates the release of goods without original documents.

Common Uses of Bank Guarantees:

Performance Guarantees – Ensuring contractors meet obligations in construction and infrastructure projects.

Advance Payment Guarantees – Protecting buyers when making upfront payments.

Financial Guarantees – Ensuring loan repayment in case of borrower default.

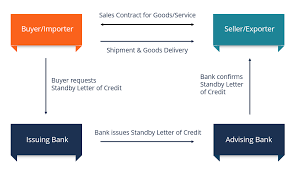

What is a Standby Letter of Credit (SBLC)?

A standby letter of credit (SBLC) is a financial instrument used as a backup payment guarantee. It ensures that if the applicant (buyer or borrower) fails to fulfill their payment obligations, the bank will compensate the beneficiary upon presentation of required documents.

Unlike bank guarantees, an SBLC follows a more structured documentary process, making it a crucial tool in international trade and cross-border transactions.

Types of Standby Letters of Credit (SBLC).

There are two main types of Standby Letters of Credit, each serving different purposes:

- Performance SBLC: This type of SBLC ensures that non-financial contractual obligations are met. These obligations might include quality standards, delivery schedules, or other performance criteria. If the importer fails to meet these obligations, the bank will compensate the beneficiary, typically the exporter, for any losses incurred.

- Financial SBLC: This SBLC guarantees that financial obligations are fulfilled. It ensures that payment is made if the importer does not settle the payment for goods or services received. Financial SBLCs can also be issued in favor of the exporter’s bank, providing additional security in financial transactions.

Common Uses of SBLCs:

Trade Finance – Ensuring exporters receive payment for goods or services.

Project Financing – Securing funds for large-scale business ventures.

Credit Enhancement – Strengthening financial credibility for businesses seeking loans.

Financial Guarantees- SBLCs can be used as financial guarantees for various purposes such as lease agreements, payment obligations, or supplier contracts. They provide a level of security and assurance to parties involved in the transaction.

BG vs SBLC: Key Differences

| Criteria | Bank Guarantee (BG) | Standby Letter of Credit (SBLC) |

|---|---|---|

| Purpose | Ensures performance or obligation fulfillment | Provides backup payment security |

| Usage | Common in construction, real estate, and local business transactions | Predominantly used in international trade and finance |

| Payment Process | Activated upon default, with minimal documentary requirements | Requires presentation of specific documents for payment |

| Legal Framework | Governed by local banking regulations | Regulated under UCP 600 and ISP 98 for international standardization |

| Cost & Fees | Generally lower fees | Higher costs due to document verification and processing |

Why Choose Artley Finance (HK) Limited for BG & SBLC Services?

As a trusted bank guarantee provider and SBLC provider, Artley Finance (HK) Limited specializes in issuing and monetizing financial instruments tailored to your business needs. Whether you need a bank guarantee (BG) for a construction project or an SBLC to secure an international trade deal, we offer comprehensive solutions backed by AAA-rated banks.

Our Services Include:

Bank Guarantee Issuance – Strengthen your credibility in financial transactions.

Bank Guarantee Issuance – Strengthen your credibility in financial transactions.

Standby Letter of Credit (SBLC) Issuance – Secure your global trade agreements.

Standby Letter of Credit (SBLC) Issuance – Secure your global trade agreements.

BG & SBLC Monetization – Convert financial instruments into cash through our trusted SBLC monetizer services.

BG & SBLC Monetization – Convert financial instruments into cash through our trusted SBLC monetizer services.

Leased BG & SBLC – Gain temporary access to financial guarantees for trade and business growth.

Leased BG & SBLC – Gain temporary access to financial guarantees for trade and business growth.

Business Loans – Get fast financing at competitive rates.

Business Loans – Get fast financing at competitive rates.

Real-World Example: How We Provided a Bank Guarantee for a UK Solar Energy Company

A UK-based renewable energy company needed funding to expand its solar power infrastructure but faced challenges in securing a bank loan. Through Artley Finance (HK) Limited, we provided a Bank Guarantee (BG) from an AAA-rated bank, allowing them to secure financing and complete the project successfully. The BG acted as collateral, ensuring the bank’s confidence in funding the expansion.

Partner with Artley Finance – The Leading BG & SBLC Monetizer

If you’re looking for a reliable bank guarantee provider or SBLC monetizer, Artley Finance (HK) Limited offers fast, secure, and customized financial solutions.

Contact us today to unlock new trade finance opportunities!

Visit: www.artleyfinance.com