THE PROS AND CONS OF BANK GUARANTEES VS. LETTERS OF CREDIT: WHAT YOU MUST KNOW

Artley Finance (HK) Limited Facilitates €284 Million Financing for Poland’s Baltica 5 Offshore Wind Project

February 11, 2025

Genuine SBLC Provider – Finding a Trusted SBLC & Bank Guarantee Provider

February 13, 2025THE PROS AND CONS OF BANK GUARANTEES VS. LETTERS OF CREDIT: WHAT YOU MUST KNOW

Introduction

In today’s fast-paced business world, securing transactions is a top priority. Whether you’re a business owner, contractor, or exporter, choosing between a bank guarantee and a letter of credit can be a game-changer. While both offer financial security, they serve different purposes, and picking the wrong one could cost you time and money. Let’s break it down in simple terms.

What is a Bank Guarantee?

Imagine you’re a contractor bidding on a major construction project. The client wants assurance that if you fail to deliver, they won’t be left stranded. This is where a bank guarantee comes in, it’s your financial backup plan. The bank steps in and covers your obligation if you default.

What Are The Types Of Bank Guarantees?

- Financial Guarantee: This ensures that if the buyer defaults on payment, the bank will compensate the seller. It’s commonly used in large business contracts where timely payments are critical to maintaining cash flow.

- Performance Guarantee: This guarantees that the contracted work or service will be completed as agreed. If the contractor fails to deliver, the bank compensates the affected party. Industries like construction, engineering, and manufacturing often use this type of guarantee.

- Advance Payment Guarantee: Businesses often require advance payments to fund projects or procure materials. This guarantee assures the buyer that their advance payment will be refunded if the seller doesn’t fulfill their contractual obligations.

- Bid Bond Guarantee: When companies bid for contracts, they often need to provide a guarantee that they will honor their bid if selected. If they withdraw or fail to meet the requirements, the bank compensates the project owner.

- Deferred Payment Guarantee: In long-term agreements, a deferred payment guarantee assures that the seller will receive payments as per the agreed schedule. This is particularly useful in high-value contracts that involve installment-based payments.

- Shipping Guarantee: Used in international trade, this guarantees that a buyer can take possession of shipped goods even before the bill of lading arrives. It helps businesses avoid costly shipping delays.

Why Bank Guarantees Matter:

Bank guarantees play a crucial role in modern business transactions, offering security, trust, and financial stability. And they are essential because of the following:

It Builds Trust Between Parties

Whether in construction, import/export, or procurement, a bank guarantee ensures that both the buyer and seller have confidence in the transaction. The seller is reassured of receiving payment, while the buyer knows the work will be completed as agreed.

It Facilitates Larger Business Deals

Many businesses, especially small and medium enterprises (SMEs), struggle to secure large contracts due to financial limitations. A bank guarantee allows them to bid for high-value projects by providing assurance to the contracting party.

Reduces Financial Risk

Businesses face risks such as non-payment, contract defaults, and performance failures. A bank guarantee mitigates these risks by providing compensation if contractual obligations are not met.

Enhances Credibility and Market Reputation

Companies that can provide bank guarantees demonstrate financial strength and reliability. This helps build long-term relationships with partners, suppliers, and clients.

Supports International Trade and Expansion

For businesses involved in global trade, bank guarantees help overcome barriers such as lack of trust between new trading partners, legal complexities, and currency risks. By offering a guarantee, businesses can enter new markets with greater confidence.

What is a Letter of Credit?

Now, let’s say you’re an exporter shipping goods overseas. You don’t want to risk non-payment, and your buyer doesn’t want to pay upfront without assurance of delivery. A letter of credit (LC) solves this problem. It’s a bank’s commitment to pay the seller once the conditions in the agreement are met.

Types of Letters of Credit:

Irrevocable Letter of Credit:

This type of LC cannot be altered or canceled without the agreement of all parties involved. It provides a high level of security and is widely used in international trade transactions.

Confirmed Letter of Credit:

In this type, a second bank (often in the seller’s country) confirms the LC, providing additional security. This is beneficial for exporters dealing with buyers in countries with unstable economies or weak banking systems.

Sight Letter of Credit:

Payment is made immediately upon presentation of the required shipping and transaction documents. This ensures quick payment to the seller, making it a preferred choice in fast-paced industries.

Deferred Payment Letter of Credit:

Unlike a sight LC, payment is made at a later date as agreed in the contract. This helps buyers manage their cash flow while giving sellers a secure commitment to receive payment.

Revolving Letter of Credit:

Suitable for businesses with ongoing trade relationships, this LC allows multiple transactions within a specified period without the need for repeated approvals.

Transferable Letter of Credit:

Allows the original beneficiary (seller) to transfer all or part of the LC to a third party, often used in supply chain financing and intermediary trading.

Standby Letter of Credit (SBLC):

Functions similarly to a bank guarantee, as it acts as a backup payment method in case the buyer defaults. It’s widely used in long-term service contracts and large-scale transactions.

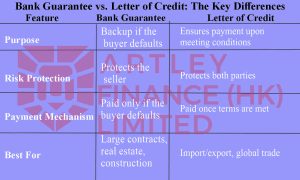

Bank Guarantee vs. Letter of Credit: A side-by-side comparison of their purpose, risk protection, payment terms, and ideal applications

Understanding the nuances between bank guarantees and letters of credit can save you from financial headaches. Before making a decision, analyze your transaction type, risk tolerance, and cost implications.

And if you need expert advice on choosing the right financial instrument Contact us today and safeguard your business transactions!

How do I apply for a bank financial instrument?

Send your requirements via email: finance@artleyfinance.com. Our team will guide you through the process.

Contact Artley Finance (HK) Limited

Email: finance@artleyfinance.com

Email: finance@artleyfinance.com

Website: www.artleyfinance.com

Website: www.artleyfinance.com