The Role of Bank Drafts in Ensuring Secure Payments

Provedor SBLC genuíno: como encontrar um provedor SBLC e de garantia bancária confiável

February 14, 2025

Bank Draft vs. Wire Transfer: Which is Safer for Large Transactions?

February 16, 2025The Role of Bank Drafts in Ensuring Secure Payments

In today’s financial landscape, secure and reliable payment methods are crucial for businesses and individuals alike. One such trusted instrument is the bank draft. Bank drafts offer a secure way to transfer funds, reducing the risk of fraud and ensuring that recipients receive payments without complications. This article explores the role of bank drafts in securing payments, their advantages, how they work, and their relevance in modern banking.

What is a Bank Draft?

A bank draft, also known as a cashier’s check, is a payment instrument issued by a bank on behalf of a customer. The issuing bank guarantees the payment, ensuring that the recipient receives the specified amount. Unlike personal checks, which can bounce due to insufficient funds, bank drafts are prepaid, making them more secure and trustworthy.

How Do Bank Drafts Work?

1. Request and Issuance

A customer initiates a request for a bank draft by visiting their bank or using online banking services. The bank verifies the availability of funds in the customer’s account before deducting the specified amount. Once the payment is confirmed, the bank issues a bank draft payable to the recipient. The draft contains details such as the payee’s name, the amount, and security features to ensure authenticity.

2. Security and Authentication

Bank drafts come with built-in security features to prevent fraud. These include watermarks, holograms, special inks, and unique serial numbers. These security measures make it difficult to counterfeit or alter a bank draft, providing confidence to both the payer and the recipient.

3. Delivery to the Recipient

Once issued, the customer can either hand-deliver or mail the bank draft to the recipient. Unlike electronic payments, a bank draft is a physical document, reducing the risk of online fraud and unauthorized access.

4. Clearance and Settlement

Upon receiving the bank draft, the recipient deposits it into their bank account. The recipient’s bank then verifies the draft’s authenticity and processes it for clearance. Since the bank draft is guaranteed by the issuing bank, there is no risk of insufficient funds, making the transaction more secure. The recipient’s bank credits the amount to the payee’s account once the draft clears.

Advantages of Using Bank Drafts for Secure Payments

1. Fraud Prevention

Bank drafts are one of the most secure payment methods available. Their built-in security features make counterfeiting extremely difficult. Additionally, since the issuing bank guarantees the payment, there is no risk of bounced checks or fraudulent reversals.

2. Irrevocable Payments

Once a bank draft is issued, it cannot be canceled or reversed. This makes it an ideal choice for transactions that require an assured payment method, such as real estate purchases, business transactions, or legal settlements. Unlike credit card payments or electronic transfers, a bank draft ensures that the recipient receives the full amount without the risk of chargebacks.

3. Acceptance in International Transactions

Bank drafts are widely accepted in international transactions. Since they are backed by banks, they provide a reliable and recognized method of payment across borders. Many businesses and individuals prefer bank drafts for large international transactions because they eliminate the risks associated with currency fluctuations and online fraud.

4. No Requirement for Recipient’s Bank Details

Unlike wire transfers, where the sender must provide the recipient’s banking information, a bank draft only requires the payee’s name. This adds an extra layer of security, as sensitive banking details do not need to be shared, reducing the risk of identity theft or unauthorized access.

5. Ideal for Large Transactions

For significant financial dealings, such as purchasing real estate, vehicles, or business acquisitions, bank drafts provide a secure and trusted method of payment. Since they are guaranteed by the bank, sellers and service providers can confidently accept bank drafts without worrying about payment failures or disputes.

Comparing Bank Drafts with Other Payment Methods

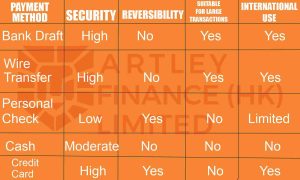

Bank Drafts vs. Other Payment Methods: A Security & Reliability Comparison – This table highlights the advantages of bank drafts over wire transfers, personal checks, and credit cards for secure and large-scale transactions.

Potential Drawbacks of Bank Drafts

While bank drafts are known for their security and reliability, they are not without limitations. Understanding these drawbacks can help individuals and businesses make informed decisions when choosing a payment method.

1. Issuance Fees

One of the main disadvantages of bank drafts is the cost associated with issuing them. Most banks charge a fee for issuing a draft, which can vary depending on the financial institution and the transaction amount. Compared to other payment methods like online bank transfers or personal checks, which may have lower or no fees, bank drafts can be an expensive option, especially for frequent transactions.

2. Processing Time

Unlike digital payments that can be completed instantly or within a few hours, bank drafts require manual processing and verification, which can take a few business days. The recipient must deposit the draft at their bank, where it undergoes authentication before the funds are cleared. If the transaction involves international payments, the processing time may be even longer due to cross-border banking regulations and currency conversion requirements.

3. Risk of Loss or Theft

Since bank drafts are physical documents, there is always a risk of misplacement, loss, or theft. If a draft is lost or stolen, replacing it can be a lengthy and complex process. The issuing bank may require additional verification and may not reissue the draft immediately, leading to delays. In some cases, financial institutions may require a formal investigation before authorizing a replacement, which can be inconvenient, especially for urgent payments.

How to Cancel a Bank Draft

Once a bank draft is issued, canceling it isn’t always straightforward. Many banks don’t allow stop payments on drafts because the funds have already been withdrawn from the issuer’s account and are considered guaranteed payments.

However, if you need to reverse the transaction, most banks will require you to redeem the draft for its full amount. In cases where the draft is lost, stolen, or damaged, cancellation or replacement may be possible, but you’ll need to provide the necessary documentation—such as proof of purchase and identification to request a new draft.

Are Bank Drafts Still Relevant in the Digital Age?

With digital banking, instant transfers, and even cryptocurrency taking center stage, it’s easy to wonder if bank drafts are becoming obsolete. But the truth is, they still hold an important place in finance—especially when security and guaranteed payments matter most.

For high value transactions, legal settlements, and international payments, bank drafts remain a trusted and widely accepted option. Unlike digital transactions, which can be vulnerable to fraud or payment reversals, bank drafts offer a bank backed guarantee that ensures the recipient gets paid. This makes them particularly useful in situations where trust and fraud prevention are top priorities.

While technology continues to evolve, bank drafts haven’t lost their relevance—they’ve simply become a specialized tool for transactions that demand absolute security and reliability.

1 Comment

[…] bank draft is a secure payment instrument issued by a bank on behalf of a customer. The bank withdraws the […]