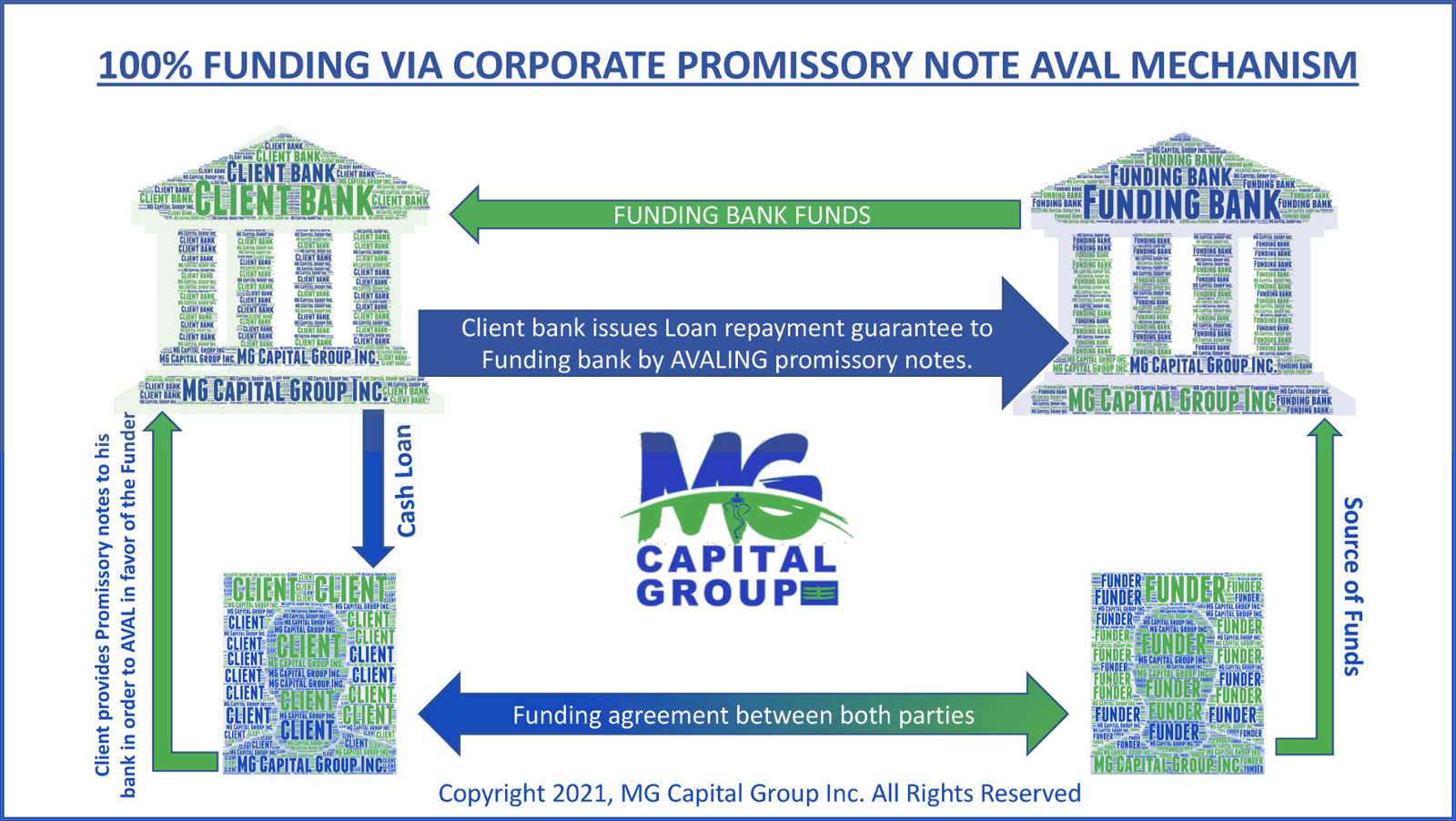

Corporate Promissory Note Funding

There are some Banks in the world call to this program as:

- Supplier’s Funding / Credit.

- Buyer’s Funding.

The Promissory Note submitted to the client’s bank (the receiver bank) for the benefit of the Funder, and the bank will provide an endorsement with commitment against receiving the funds, there are 3 options below.

- The client’s Bank endorsed Bank AVAL. We only accept world top 50 banks. We do not accept non rated banks.

- The client’s Bank issue a Bank Guarantee (BG) / Standby Letter of Credit (SBLC) as a guarantee and

- Issue Demand Guarantees

Two options to do the transaction:

- THE CLIENT HAVE TO PAY THE INTEREST PLUS FEE (18%) FEE FIVE DAYS AFTER THE FUNDER DELIVER THE FUNDS INTO THEIR ACCOUNT OR DISCOUNT THE AMOUNT FROM THE LOAN AND THE BANK ENDORSED PRINCIPAL FULL FOR 365 DAYS.

- THE CLIENT HAVE TO PAY 3% FIVE DAYS AFTER THE FUNDER DELIVER THE FUNDS INTO THEIR ACCOUNT OR DISCOUNT THE AMOUNT FROM THE LOAN AND THE BANK ENDORSED PRINCIPAL AND INTEREST FULL FOR 365 DAYS.

Why the receiver bank will agree to approve the transaction?

There are many reasons your Bank will be interested in the transaction; all is how you sell your story and Executive summary of the business/project to the bank.

- You are bringing outside Cash into your Bank account.

- Your Bank is in a position to develop to create multiple income streams from that deposit of Funds.

- Your Bank does not need to use their own funds to provide a credit facility against a BG/SBLC.

- Your Bank can receive the funds on your behalf and disburse those funds in accordance with a schedule related to your project; this helps the bank control their risk.

- Your Bank can leverage those cash funds up to 5-10 times depending on the reserve regulations of the country that the bank operates.

You can pay to the Funder the principal and interest at the end of the year.

You will have the support of your Bank for your , only if you provide them with a proper and realistic presentation of the following;

- USE OF FUNDS

- MITIGATION OF RISK

- VIABILITY OF THE EXIT STRATEGY

Once the Client provides the Bank with a clear understanding of the above elements, then you will have a Bankable deal and you will have Bank support.

Business/Project you can utilize the CPN Funding:

- Buyer’s Funding.

- Leverage funds for Trade and Commodity Business.

- Leverage capital for equity and senior debt.

- Leverage funds for buy/sell Business.

- Expanding business activity.

- Mergers and acquisitions.